In today’s fast-paced corporate environments, prioritizing human well-being has become increasingly important. Research by Gallup demonstrates that companies with highly engaged employees outperform their competitors by up to 147% in earnings per share. Yet, many organizations struggle to create environments that genuinely prioritize employee satisfaction and engagement.

The contrast between family-owned businesses and SMEs versus shareholder-owned corporations highlights a fundamental reality: company structure and leadership significantly impact employee well-being and innovation potential. Moreover, employment security and rewarding career opportunities nourish trust in social and economic models, and provide a sense of stability.

This raises an essential question in light of recent global concerns about technological and political developments: do we need to rethink how businesses are built in Europe?

Innovative Structures

The “human factor” is a key determinant of organizational success. However, many companies inadvertently suppress it through what can be described as the “Ego Factor” in leadership. This dynamic manifests differently across organizational structures, leading to distinct patterns in employee engagement and innovation, but seems more prevalent in larger structures with an emphasis on career advancement through the corporate hierarchy system.

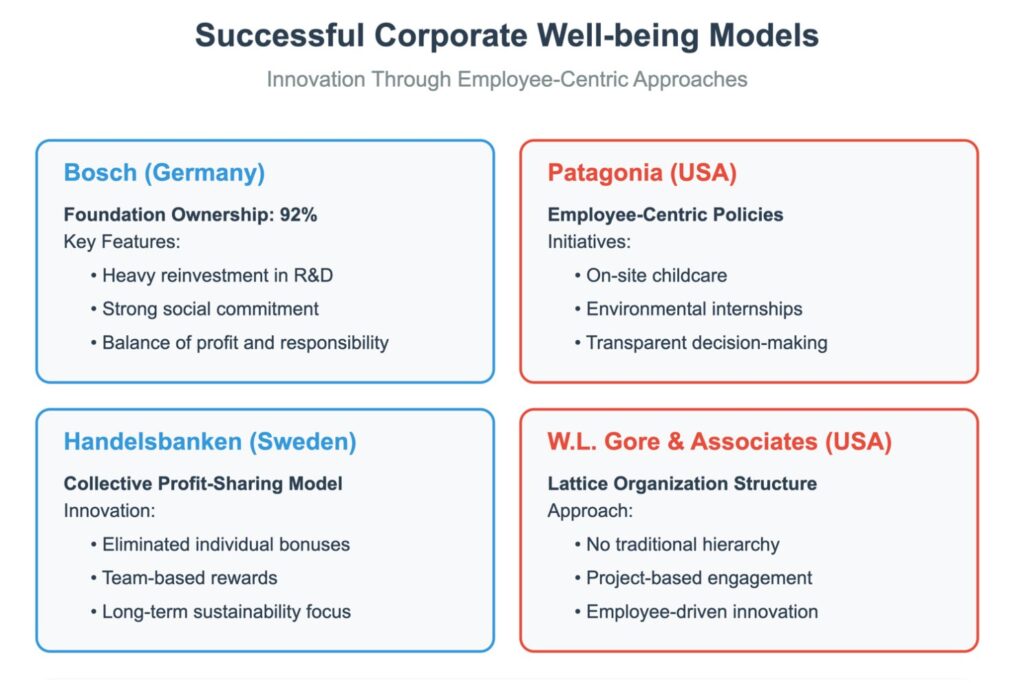

Family-owned businesses and SMEs often excel at fostering inclusive environments where employees experience genuine ownership and responsibility. In Europe, companies like Germany-based Bosch demonstrate how family ownership can successfully scale while maintaining strong customer and employee-centric values. As a foundation-owned company, Bosch reinvests heavily in employee development and innovation, while maintaining a strong social commitment. Their unique ownership structure (the Robert Bosch Stiftung holds 92% of the shares) ensures that profit maximization doesn’t override social responsibility and employee well-being.

Similarly, Patagonia, under Yvon Chouinard’s leadership, implemented forward-thinking policies that include on-site childcare facilities, environmental internship programs, and transparent decision-making processes incorporating employee input. W.L. Gore & Associates took a different approach by eliminating traditional hierarchies. Instead, it uses a lattice structure where employees (“associates”) can commit to projects based on their interests and expertise. This approach has led to innovations such as GORE-TEX fabric, driven by employee initiative rather than top-down directives.

In contrast, many large corporations struggle with innovation and employee engagement due to hierarchical structures that prioritize shareholder value over workforce well-being. A notable example is Nokia’s decline in the late 2000s. Despite a strong engineering culture, Nokia’s rigid hierarchy and slow decision-making hindered its ability to innovate quickly, ultimately leading to the sale of its smartphone division to Microsoft.

Another instructive case is General Electric under Jack Welch. While initially tremendously successful, with immense revenue and profit increases, Welch’s aggressive management style led to decreased employee collaboration, reduced risk-taking, and higher turnover rates among middle management. This focus on short-term gains at the expense of long-term innovation contributed to GE’s subsequent challenges, including its removal from the Dow Jones Industrial Average in 2018 after more than a century of membership.

When organizations don’t actively implement and maintain structures to promote human morale in the workplace, employee well-being becomes an afterthought rather than a strategic priority. This oversight often leads to decreased innovation, higher turnover, and reduced long-term sustainability.

Ownership and Accountability

Leadership styles and accountability structures shape organizational culture. Research from MIT’s Sloan School of Management suggests that companies whose leaders are primarily accountable to shareholders experience 23% higher employee turnover compared to those with broader stakeholder accountability.

Different accountability structures impact businesses in specific ways. When the primary concern is shareholder accountability, there tends to be more focus on quarterly financial results, pressure to maintain stock prices, and a tendency to maximize earnings by workforce cost-cutting.

Workforce accountability emphasizes long-term sustainability, increased investment in employee development, and higher rates of innovation and process improvement. When the focus is on customer accountability, there tends to be a balanced approach to growth, a stronger focus on quality and service, and more stable employment practices.

The significance of these accountability forms cannot be underestimated. Higher employee involvement consistently leads to less staff turnover, a more stable workforce, and an overall better-functioning business.

Despite clear benefits, employee ownership models remain underutilized. In the U.S., only around 6,500 companies operate Employee Stock Ownership Plans (ESOPs). An example of successful implementation is King Arthur Baking Company; it is consistently ranked as the best place to work, is 100% employee-owned, and has high levels of employee innovation and engagement. In Europe, success stories such as the John Lewis Partnership (UK) and Mondragon Corporation (Spain) demonstrate how employee ownership can foster resilience and engagement.

However, several barriers to employee ownership exist, including the complexity of legal and financial requirements, resistance from existing leadership structures, limited awareness of available applicable models, and fear of losing control among executives.

Contrasting European and American Approaches

The approaches to corporate governance and employee well-being differ significantly between Europe and the United States, shaped by distinct cultural, legal, and historical contexts.

The European model includes a stakeholder-oriented approach with formal employee representation through works councils and co-determination laws (such as Germany’s “Mitbestimmung”). These participatory structures, along with strong social safety nets, influence corporate responsibility and emphasize long-term stability over short-term profit.

In contrast, the American model generally has shareholder primacy in corporate governance, more flexible labor markets with less employee protection, and emphasizes earnings and stock performance, with a greater focus on individual achievement. This emphasis, coupled with performance-based rewards, often translates to commission-based incentive structures that can create internal competition and reduce collaboration.

Progressive companies on both sides of the Atlantic have pioneered alternative approaches. While Menlo Innovations in the U.S. has developed innovative team-based systems, European companies like Handelsbanken (Sweden) have eliminated individual bonuses entirely in favor of collective profit-sharing schemes. Similarly, Barry-Wehmiller (with significant European operations) has implemented a unique “Truly Human Leadership” model that emphasizes people-centric practices.

These companies demonstrate approaches that include team based compensation models, profit-sharing programs for employees, recognition systems that reward collaboration, and long-term incentives tied to company sustainability goals.

American companies typically demonstrate faster growth during boom periods, whereas European companies often show greater resilience during economic downturns. The contrast between these approaches offers valuable insights for global best practices; hybrid models are emerging in both regions, adopting beneficial aspects of each approach.

Advocating for the European Model

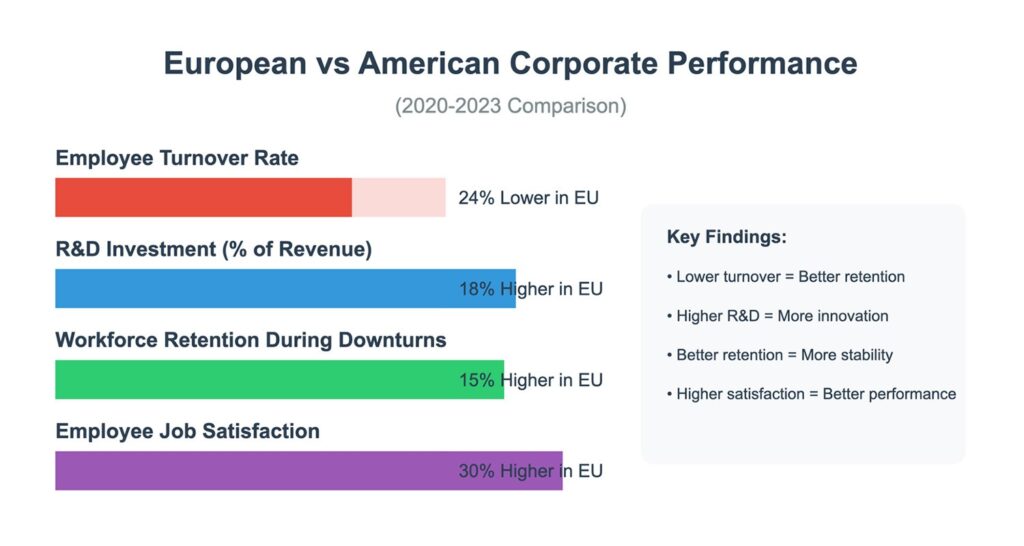

Recent global developments in politics en technology have highlighted the strategic importance of maintaining strong, independent corporate structures within Europe. Statistical data from 2020-2023 reveals compelling patterns in corporate performance:

- European companies with strong employee participation showed 24% lower turnover rates than their U.S. counterparts.

- Companies following the German Mitbestimmung model demonstrated 18% higher R&D investment relative to revenue.

- EU-based family businesses maintained an average of 15% higher workforce retention during economic downturns.

- Employee-owned European companies reported 30% higher job satisfaction scores.

The success of different approaches to corporate well-being often depends heavily on cultural context. European companies generally benefit from a stronger cultural emphasis on work-life balance and a greater acceptance of collective decision-making. There are more established traditions of social partnerships, including formal collaboration between labor unions, industry associations, and government bodies, as well as more regulated working hours and vacation policies. On the flip-side, European companies are confronted with slower decision-making processes, higher fixed labor costs, and more complex stakeholder structures, often with resistance to rapid organizational change.

American companies, while often more agile, frequently struggle with higher employee turnover, greater income inequality within organizations, and work-life balance issues. More importantly, recent political polarization and social media influence on corporate decision-making have shown that when large corporations are easily swayed by political pressures, resulting mass layoffs can disrupt socio-economic stability and lead to loss of trust in both governments and companies.

The Future of Corporate Well-Being

The evidence suggests that companies prioritizing human well-being through inclusive ownership structures and balanced leadership approaches achieve superior long-term results. As workforce expectations evolve, organizations can adapt and move beyond hierarchical, shareholder-driven models. Instead, embracing strategies that enhance engagement, innovation, and corporate resilience can bring stability and prosperity to companies and communities.

Businesses that bridge the gap between shareholder interests and employee well-being will likely emerge as future leaders in workforce stability. The challenge lies not in recognizing the importance of the human factor but in having the courage to implement structural changes that truly prioritize it. As we continue to navigate the complexities of the modern corporate world, let us remember that the human factor is not just a component of success—it is the foundation upon which sustainable and innovative companies are built.

https://www.linkedin.com/pulse/human-factor-rethinking-corporate-well-being-roland-biemans-mhcvf

Comments are closed